Bullets in the gun

You only have so many bullets to fire, only so many hours in the day. In a metals bull market why not make every shot count?

Don’t you hate when you get sick over the weekend and get better in time to go back to work Monday morning? Me too.

Late Monday notebook …

Portfolio updates

Current and future spinouts

Selling Birchtech; ETHE options trade

Interesting links

Not working at Arby’s

Portfolio Updates

Mayfair Gold closed a LIFE financing for $40-million and gained a new strategic shareholder. Howard Marks’ Oaktree Capital Management, a subsidiary of Brookfield Asset Management, now owns 6.7% of Mayfair. Two things can be true at the same time.

This is not a significant position for Oaktree in the context of its $209-billion US assets under management.

Oaktree did not have to reveal its ownership stake in Mayfair immediately. An investment firm famous for bottom fishing deciding to publicly tie itself to a junior mining company is a significant vote of confidence.

The cash from the financing gives management a two-year runway to move development of the Fenn-Gib deposit forward. But I thought this was the most significant part of the release.

This financing also gives Mayfair the financial flexibility to consider an exploration program in the southern block, located within 5 kilometres of the Fenn-Gib project site and on trend from multiple deposits and mines.

Mayfair believes there is more gold along trend1. I agree with them and don’t believe that optionality is reflected in the share price. I’ve averaged up and made this something closer to a full position.

Selling Star Royalties

Not lucky, because I believe I bought well. But I do consider myself fortunate that I’m walking away from Star Royalties with a 17% return after holding for less than a year.

This was never a large position given the lack of liquidity. With the returns on my other gold positions, STRR had become an even smaller part of the portfolio. I haven’t had any luck finding someone to take on the job of crystallizing the portfolio value by pushing management for an immediate sale of the Copperstone gold stream. At the end of the day, the money sitting in Star was better put to use elsewhere (See Eagle Plains below).

Chibougamau Independent Mines

A run in the share price based on almost zero trading volume.

I couldn’t sell even if I wanted to. As my investment process and bankroll evolve, CBG and Vulcan Minerals are not positions I would buy today. My preference is for illiquid positions outside the mining sector and without any cash burn at all. That said, Vulcan (Great Atlantic 3% NPI and ~30% ownership in Atlas Salt) and Chibougamau (2% GMR on the Mont Sorcier iron deposit) are worth multiples of their current market caps.

Spinouts

Orecap Invest has received shareholder approval for three new spinout companies. Closing of the plan of arrangement is expected by the end of the month. The companies will remain private until OreCap has an asset to drop into them. I was hoping to build a position in time to collect the spinout shares, but wasn’t nimble enough.

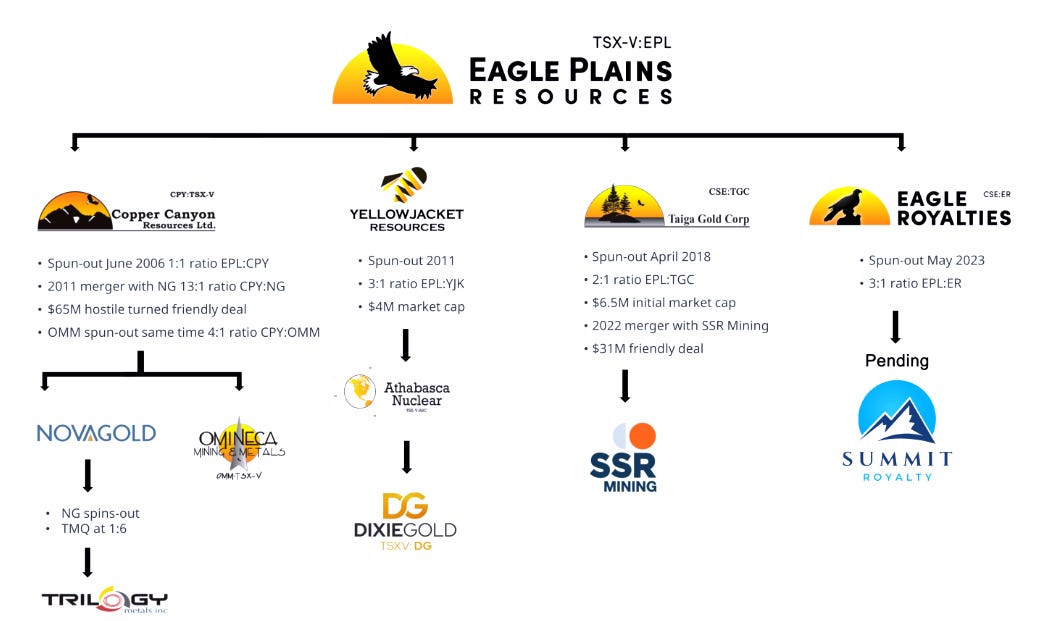

My undisclosed special situation is Eagle Plains Resources. The long-term chart doesn’t reflect the acquisition of its various spinout companies over the years, including the RTO of current portfolio holding Eagle Royalties by Summit Royalty.

EPL management has been transparent about their desire to spinout Osprey Power. Osprey has acquired the rights to develop clean energy projects across Canada and is looking to partner with power producers for development. The spin most likely happens after a first agreement that validates the business model and provides some cash.

Updated Portfolio

As of September 22, 2025

Mining

KGCRF - Kinross Contingent Value Rights

Banyan Gold

Mayfair Gold

Industrials

Comstock Inc. - Silver

Aecon - Nuclear

Clean Seed Capital - Agriculture

Royalties

Altius Minerals

Exploration/Prospect Generators

Kenorland Minerals

Orogen 2.0

Magna Terra Minerals

Vulcan Minerals

Specials/Workouts

NGEx Minerals

Eagle Plains Resources (Previously undisclosed)

Chibougamau Independent Mines

Star RoyaltiesEagle Royalties (Exiting portfolio upon completion of RTO/resumption of trading)

Raw Commodities

Sprott Physical Uranium Trust

Non-metals and mining portfolio updates

What a disappointment Birchtech has been. I’ve reduced the position size here by 75%.

There’s no PFAS water treatment business, which is what they’ve been talking about for the last year. Even if there was you’d rather own ARQ, or consider yourself lucky the business never took off considering the EPA only confirmed today that it was retaining the hazardous substance designation for two PFAS compounds.

Birchtech was primarily a patent litigation play for me, and that ruling is taking an uncomfortably long time as we approach a year. I have no reason to believe BCHT will be awarded treble damages and it’s clear the Berkshire-Hathaway owned utilities want to take the case to trial. Combine all that with a mediocre-at-best management team that has done some odd things, like list in Toronto, and it’s time to move on. The return for the moment sits at 18% with the final number to be determined after we get the ruling on damages.

Ethereum trade update

This is the trade, using the Greyscale Ethereum Trust ETF as a proxy:

Sell Jan 2026 puts with $39 strike for $10.50

Buy Jan 2026 calls with a $39 strike for $4.50

The price of ETHE has surged 51% in the past year and is sitting at $34.50 as I write this. Time decay is doing its job and both sides of the trade are in the green. Ether is a 70-vol asset in a 80-vol asset class. Not only was the volatility mispriced in these options when I put the trade on, I’m confident that same volatility will move ETHE well into the $40s by the time we get close to expiry.

The Birchtech money is better put to use riding the gold bull market, adding to Comstock or pursuing one or two of the other mispriced 70-vol trades I’ve identified.

Interesting Links

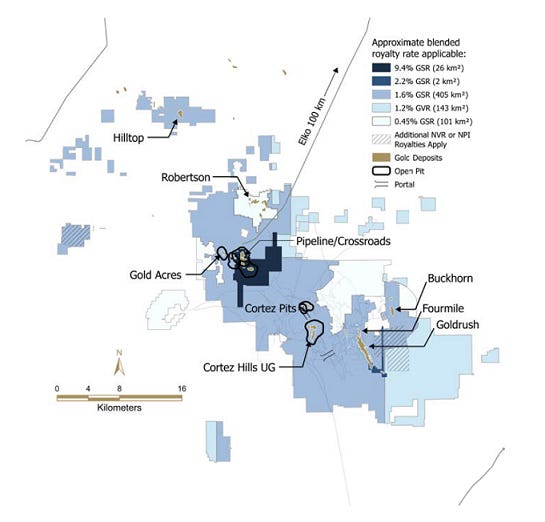

Royal Gold holds the only royalty on Barrick’s monster discovery at Fourmile in Nevada. It’s a 1.6% gross sales royalty.

Barrick CEO Mark Bristow is hopeful a significant portion of the mineralization can eventually be processed using Nevada Gold Mine’s existing facilities.

Bristow said the updated PEA pointed to the potential for Fourmile to rank among the top 10 gold producers globally, with industry-leading operating cash flows. “Very few projects anywhere in the world today can offer this combination of grade, scale and cash flow. Fourmile is one of those rare discoveries that has the potential to reset the industry cost curve.”

Barrick is looking to double the resource by the end of the year with ongoing drilling.

Cocaine trafficking generates an average annual revenue of $15.3 billion USD in Colombia, equivalent to 4.2% of the national GDP.

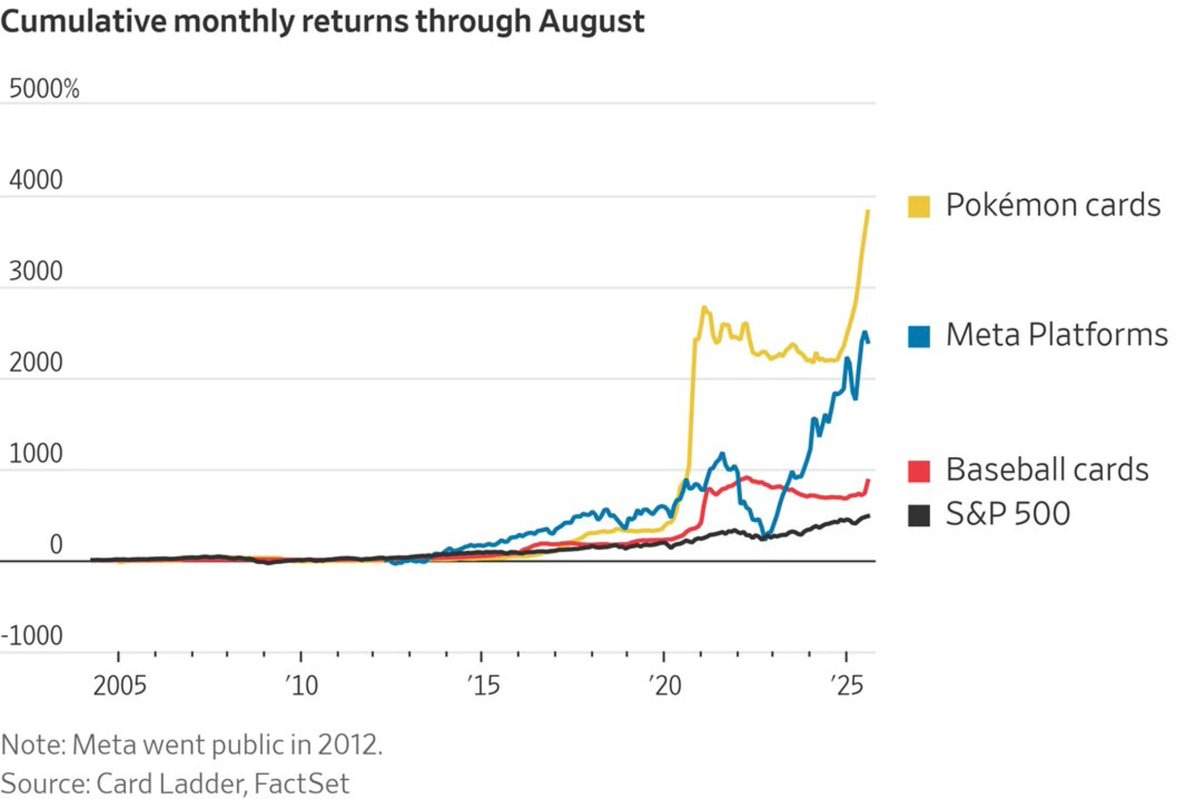

Since 2004, Pokemon cards have generated a 3,821% cumulative monthly return.

Why Druck will buy first and analyze later.

There are 156 public companies with Bitcoin on the balance sheet. How many is too many?

If you're in your 20's or 30's, read this.

“Doing what's efficient and quick, not what's optimal."

I’ve been alternating daily reps between upper and lower.

Day 1: Decline pushups (feet on the chair) and hindu pushups to get more shoulders and upper body stretch.

Day 2: Bodyweight squats and one-legged glute bridges to balance anterior and posterior chain.

What’s missing here is upper body posterior. In my house pull up bars are not considered aesthetically pleasing, so back bridges, along with traditional rows and pull downs at the gym it is.

Admin note

I’ve turned off the pledge feature in Substack. It gave the impression the newsletter is going paid one day, and it is not. I’ve stumbled onto a premium product that provides me with more value than a trickle of subscription revenue.

If I wanted a second job with no vacation, no benefits but lots of front-facing customer service, I’d go work at Arby’s.

I remember Muddy Waters having stakes in other Timmins area miners/developers, but I can’t find anything. If I’m not imagining that and you happen to know the names of those companies, please send me a note by replying to this email.

Question on $EPL.V. I tend to think that the exploration side of the PM bull market will be the last to go and it hasn't started yet. These guys seem like others like $KLD.V and $SMD.V in that they have a lot of shots on goal but not necessarily a company maker like we have seen with $FIL and Great Bear (on the extreme other end). I would assume the key will be that they monetize, which EPL clearly has a history of doing. Maybe I answered my own question lol

Looks like you and Muddy have similar interests.

https://www.theglobeandmail.com/investing/markets/indices/TXCX/pressreleases/31320131/muddy-waters-buying-more-mayfair-gold-mfg/