Weekend Mining Notebook: There are better copper options than Oroco Resource Corp.

Mining in Sinaloa; Bear Creek is probably screwed; A telegraphed 20% dividend?

In this issue …

My Oroco reservations

Friday night dump

Interesting links

I’m not sure how often I’ll be writing these. I just had a lot come to mind this week and I think it might be a good way to archive interesting links so I can come back to them later.

No, I don’t own Oroco

I recently took another look at Oroco Resource Corp. after getting five separate inquiries about the Mexican copper developer over the holidays. Oroco is drilling out their Santo Tomas copper deposit on the border of Sinaloa and Chihuahua provinces, but it’s probably best known as the only mining stock owned by a prominent Youtuber. As a result, OCO.V has a cult following and retail shareholder base that I suspect doesn’t understand how mining works in Sinaloa.

The bull case I get can be boiled down to “a major will buy Oroco because …”

Large land package

Low copper grades, but it contains a minimum of 10 billion pounds of copper

Can be put into production quickly and cheaply

Infrastructure is already in place, including roads, power, water and a deepwater port.

As some of you know, I have some first-hand experience in Northern Mexico (mostly Hermosillo, Sonora and Baja). None of the bullets above reference current conditions on the ground.

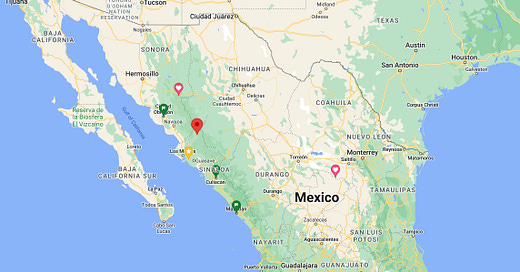

Sinaloa has been in the news because of the arrest of Ovidio Guzman, the son of jailed drug lord "El Chapo" Guzman. In response the Sinaloa drug cartel has turned multiple cities into a war zone, killing dozens and trapping tourists. I dropped a few pins on a Google Map:

The red pin is Choix, and roughly approximates the location of Oroco’s Santo Tomas deposit.

The green pins are Matzalan, Culiacan and Ciudad Obregon, where the cartel is currently fighting security forces, planes have been fired upon and airports shut down.

The gold pin is my favourite. It’s the approximate location of McEwen Mining’s El Gallo gold mine in Sinaloa near the Sierra Madres. El Gallo was robbed in 2015 of $8.5-million of gold concentrate.

During my time at BNN, the only segment to cause an international incident was Andy Bell’s interview with CEO Rob McEwen about the robbery. McEwen said the quiet part out loud - his company regularly communicates with the cartel so it can operate peacefully. He walked the statement back a few days later, but if we’re being honest he just acknowledged publicly what was common knowledge and is still happening today.

A major isn’t touching Santo Tomas, and when it’s sold there will be a discount attached to the sale price. Even before Ovidio Guzman’s arrest, the cartels were splintering and becoming more violent.

So why bet on an Oroco buyout when there are so many other copper deposits with (much) better grades in (much) better locations that aren’t a CSR, ESG and operational nightmare? Rio Tinto bought Turquoise Hill (Mongolia), invested in Western Copper and Gold (Yukon) and also took a stake in Regulus (Peru). That should tell you something about Oroco in the buyout pecking order, and it’s not like permitting is a slam dunk these days either with AMLO.

Oroco is a pass for me on opportunity cost alone.

Friday Night SEDAR dump

You can learn all kinds of interesting things about mining companies that dump news on Friday night. This is what my software flagged.

Bear Creek Mining … look out below

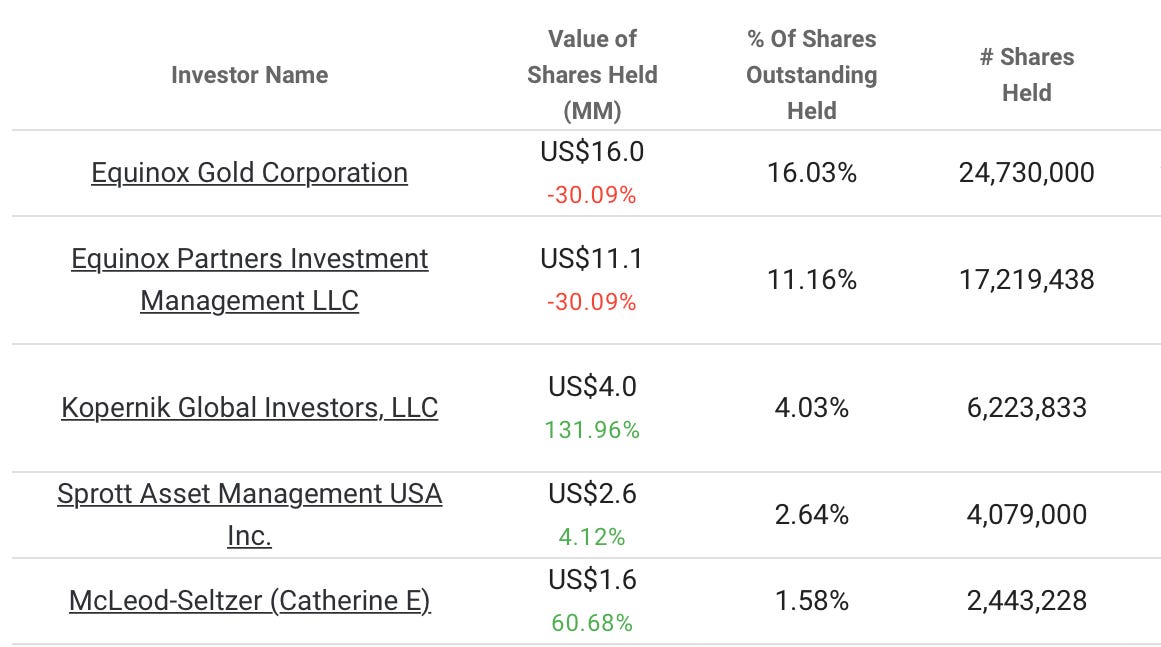

US hedge fund Equinox Partners filed an alternative monthly report after dropping below 10% ownership on Bear Creek Mining. That means they are no longer a reporting issuer and can sell BCM.V shares at their discretion going forward.

Equinox Partners is Bear Creek’s second-largest shareholder. The largest shareholder is the similarly-named-but-not-related Equinox Gold.

Equinox Gold is pretty strapped for cash these days. They’ll have to start selling something soon to repair their finances. If the hedge fund is front running EQX to get out first, Bear Creek is heading to the basement … and someone made an awful mess down there.

Options for Consultants

Options grants for consultants at a mining company announced on a Friday night? What could possibly go wrong?

Project generator Eagle Plains Resources “has granted incentive stock options to directors, employees and key consultants of the Company for the purchase of a total of 2,487,000 shares at an exercise price of $.24 per share, expiring January 6th 2028, pursuant to the Company’s current option plan (subject to shareholder and regulatory approvals).”

That’s it. They kept it brief and they buried it. But we have two pieces of recent information now:

There’s a marketing push coming…

… Which makes sense since Eagle Plains recently announced a royaltyco spin out.

There could be a trade here for those inclined to do some digging.

Financings

Seabridge Gold announced an at-the-market program to sell up to $USD100-million in shares.

G Mining Ventures filed a preliminary base shelf prospectus to raise up to $500-million. GMIN has a market cap of less than half that amount. The press release makes a point of saying GMIN may not move forward with a financing … but the company is trying to develop their Tocantinzinho gold project in a remote part of Brazil. The project already has two royalties on it.

Libero Copper and Element 29 both closed keep-the-lights-on financings of less than $2-million.

Interesting Links

A quick 20% in exchange for a little geopolitical risk?

Dave Bautista is a real actor. On the other hand Vince McMahon is playing to type.

“We’re often told our metabolism speeds up at puberty and slows down in middle age, particularly with menopause, and that men have faster metabolisms than women. None of these claims is based on real science.”

If you got to the end, thank you for reading. Feedback is always appreciated. Replies come straight to my inbox

Any further consideration of Osisko Royalties from recent events? Deconsolidation of ODEV (finally), CSA 100% Ag stream + potential copper stream, Casabel + Marimaca royalties, Renard back online, NCIB, etc. Thanks!