Notebook: Everyone hates Peter Zeihan

A little late. A little short. But you get what you pay for and there was playoff football to watch.

In this issue …

Peter Zeihan gets the important stuff right

Royalty report

Going Private

Interesting links

Peter Zeihan appears on Joe Rogan

I mostly consume the Joe Rogan podcast in bite-sized pieces via Youtube, if at all. Walking is a form of unplugging for me and I haven’t listened to podcasts regularly since the pandemic started and my commuting dropped to zero. But if you spent any time on fintwit last week it was hard to miss the appearance of geopolitical strategist and best-selling author Peter Zeihan.

The uranium bulls weren’t happy

The China experts weren’t happy

The Bitcoin bulls definitely weren’t happy

Nobody should be taking anything they hear on a Joe Rogan podcast too seriously. That said, Zeihan seems to have gotten the important stuff right.

Nuclear permitting takes forever in North America. Plutonium disposal and enrichment doesn’t matter. Think about your reaction and the reaction of your neighbours if they announced the construction of a nuclear plant in your neighbourhood.

I suspect Zeihan’s analysis about China is dead on. The whole point of the one-child policy was to curtail population growth and there’s no reason to believe China can manufacture or develop high-end micro chips. If they could, the US wouldn’t have bothered with an export ban. From pharmaceuticals to fifth-generation fighter jets, I can’t think of a single instance where a sane person would bet their life on Chinese technology versus the US equivalent.

I don’t think Bitcoin is worthless - if you live in Venezuela you’d rather own Bitcoins than Bolivars. However the use case of store of value in a hyper-inflationary economy is limited. Whether you think Zeihan is half-right or completely wrong probably depends on whether you think Bitcoin is replacing the US dollar eventually. If you think Bitcoin is taking over, I would suggest watching this Zeihan video on the dollar. If nothing else it explains the 2022 performance of gold in various currencies.

Royalty Report

All things being equal, I’d rather invest in a royalty or patent business. Much simpler to cash a cheque than dig something out of the ground so it’s a sub-sector I track pretty closely. If you need convincing this is a nice ramble on valuing royalties I’ll be saving for future reference.

Sailfish and Sandstorm

Whatever you think of the delivery, Mark Turner’s IKN blog does a good job documenting the history of Sailfish Royalty’s silver asset and extrapolating the likely returns.

He also goes through the latest quarter from Sandstorm Gold in detail. Most useful for me was the historical context of how badly management has allocated capital.

Osisko Gold Royalties

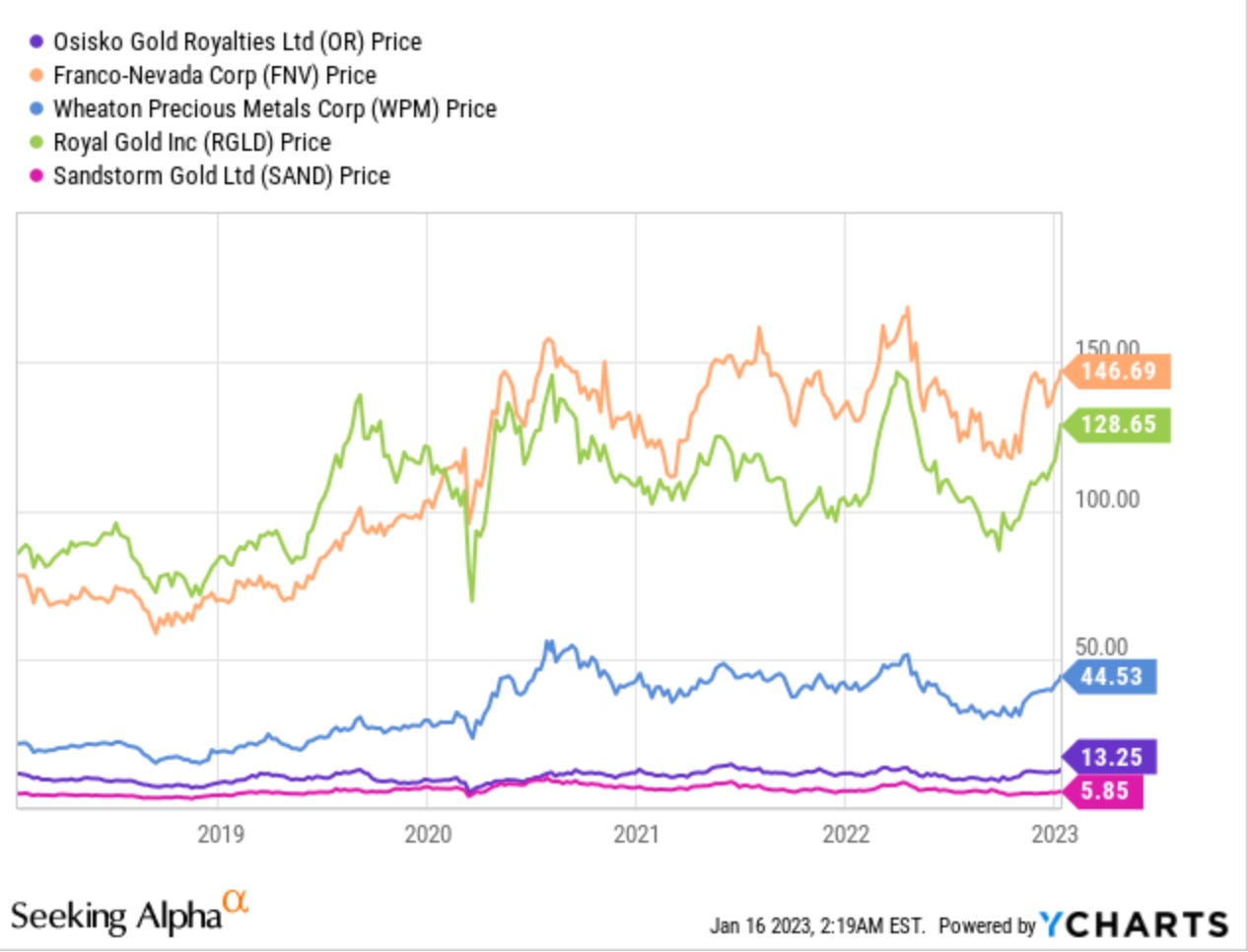

The Sandstorm analysis confirmed the consensus valuation of Sandstorm and Osisko Gold Royalties, a stock I dumped because they couldn’t sit still and cash their royalty cheques. I really wanted to like CEO Sandeep Singh and his plan to close the valuation gap with Franco, Royal Gold and Wheaton by buying back shares and streamlining the company’s assets.

But I ultimately learned that you can’t judge management by what they say, only by what they do. Particularly when they do it over and over.

Historical missteps are reflected in the long-term stock price.

The performance of OR is even more disappointing considering the other company that started life with a Malartic royalty dropped into its lap was Abitibi Royalty. Abitibi was one of the best performing stocks on the TSX for years before it was taken out by Gold Royalty last year. Abitibi followed a simple plan of returning cash to shareholders and not shooting itself in the nuts with a staple gun every few years by pursuing some convoluted deal.

Osisko may succeed in changing hearts and minds eventually, but I’ll be watching from the sidelines this time.

Listings

Empress Royalty upgraded its US listing to be 35% less shitty. What isn’t shitty is the performance of the stock since announcing, and closing, a private placement last year.

Vox Royalty rang the bell at the Nasdaq and now has a full US listing under the ticker VOXR.

Going Private

Sacha at Divestor breaks down the Canaccord privatization proposal by management, including a detailed look at the balance sheet and where the value may be hiding. But it was this quote that spoke to me.

“One danger of investing in smaller-capped companies is that on occasion you will have management try to low-ball an acquisition of the rest of the company. Jimmy Pattison’s firm tried to take out the minority stake in Canfor (TSX: CFP) which nearly succeeded. I still remember being resentful when Cervus Equipment got taken out by management. Almost anything with the name “Brookfield” in it is susceptible to this phenomena. There are plenty of other stories out there. The danger of having these management-lead buyouts increases in proportion to the smallness of the company and the proportion of ownership of management. “

— Divestor

The whole article is worth a read. After having several company’s stolen out from under me in 2022, I’ll be investing in fewer micro caps going forward. The strategy is significantly less effective if you can’t let your winners run to subsidize the losers. My other general rule is avoiding publicly-traded subsidiaries: I want to own the company extracting the fees rather than the one paying them. Something to keep in mind as you look at Brookfield, Fairfax or Glencore related companies that may appear in equity screens.

Interesting Links

This tracks in my experience. I’ve never seen a dividend investor blow up.

I haven’t looked at Algoma Steel in any detail, but management must have done something. This sort of divergence is too extreme to be just a thing that happened.

Kingsway Financial is back on my watchlist for the first time in 20 years.

This rant doesn’t actually mean anything. It’s a lot of buzzwords meant to slip in something so subtly you may have missed it.

When an ETF is not an ETF.

Dudes are fat in all income brackets, but rich women are thinner than poor women.

Is your Roomba taking pictures of you on the can?