Notebook: Adventures in Capital Allocation

Taking a look at recent news from from Sailfish Royalty and Electric Royalties. The opportunity set awaiting Peter Marrone.

In this issue …

Life after Yamana

Sailfish undoes its Terraco takeover

Electric Royalties should just borrow my credit card

Interesting links

Three different examples of capital allocation. We don’t know the outcomes yet, but they highlight a lesson you should already know: You better trust who you’ve invested your money with.

Marrone and team go whale hunting

Yamana Gold founder Peter Marrone and CEO Daniel Racine are preparing to leave the company when the sale to Agnico Eagle Mines and Pan American Silver is completed next month. Globe mining reporter Niall McGee says their next venture is an investment vehicle that’s a combination of private equity and activist hedge fund.

“The pair, who will joined by a handful of other Yamana executives, plan to invest in early stage gold exploration companies, but the team will also consider taking much bigger bets on companies that already have mines in production.”

— Yamana Gold team in pursuit of a ‘big whale’ with launch of private capital mining venture, Globe and Mail

It appears Marrone and team are open to working with existing management but that’s not a prerequisite for an investment.

“[Marrone will] look at introducing technological improvements, cutting costs, or replacing management if need be. He’ll also explore solving the need to constantly raise new money for exploration companies, by potentially doing deals through merging an exploration company with a producer, in the hopes that cash flow from the mine will provide continuous funding for exploration.”

I can see four scenarios in a metals bull market where this strategy would work best:

Back a private exploration company

Go activist on a bloated and under-performing mid-tier

The template for this would be what happened at Iamgold last year. The company spent most of 2022 selling assets and making sure it had enough money to finish construction of Cote. It’s still too early to determine if this specific intervention was a success, but Samir Manji’s Sandpiper Group is proof that industry-specific activists can create value.

Buy a distressed asset, or something already in bankruptcy

Pure Gold is a hypothetical example of the type of asset that would fit the bill. Although dealing with the courts and creditors might be unnecessarily complicated if there are simpler opportunities.

Write a big cheque to someone who really needs the money

Given the number of cost blowouts we’ve seen, and will continue to see, it shouldn’t be hard to find a cash-strapped developer willing to negotiate on price to get their project over the line.

It was pointed out to me that Mick Davis tried PE-backed deals and failed, but there are several variations of the strategy that have been successful. Former Barrick CEO Aaron Regent formed Magris Resources to purchase a Niobium mine from Iamgold. And Eric Sprott is infamous famous for his VC-style approach where the winners more than make up for the losers.

Sailfish Royalty changes its mind

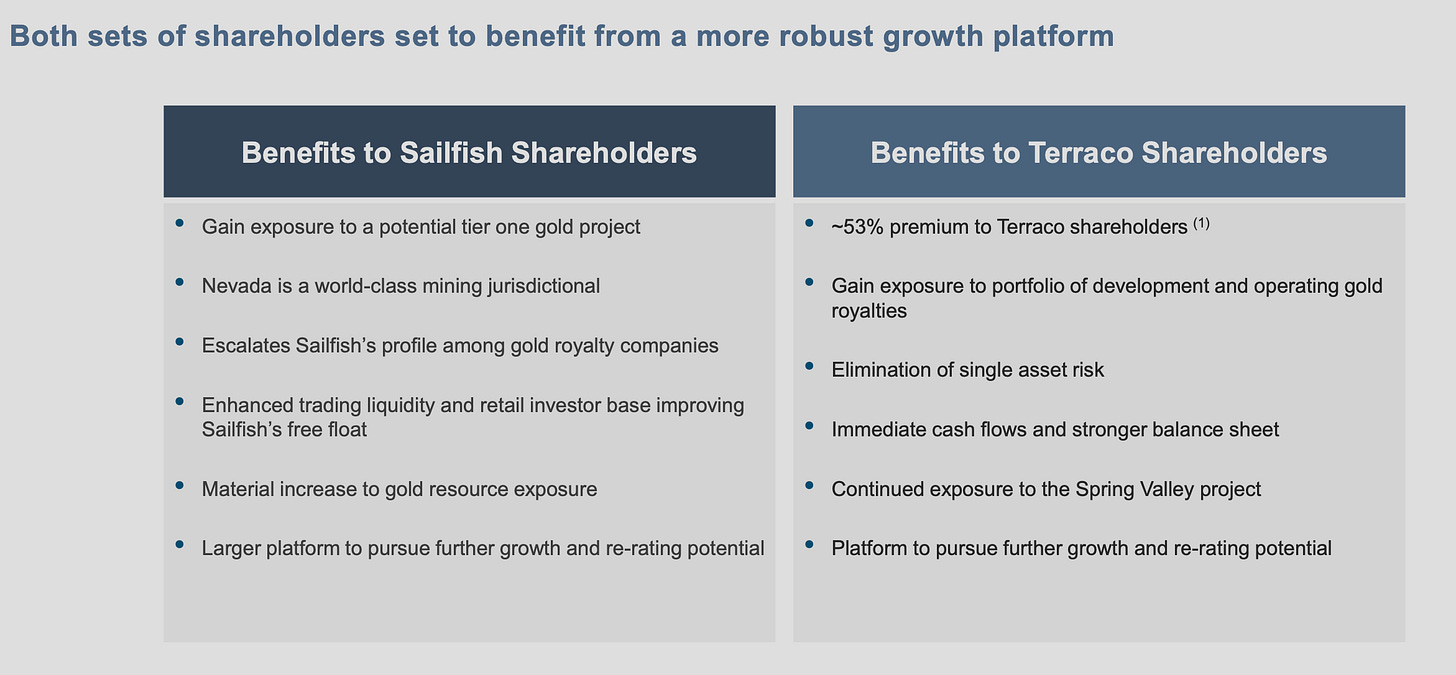

I am very familiar with Sailfish Royalty’s NSRs covering the Spring Valley deposit in Nevada. I was a shareholder in Terraco Gold, which owned the Spring Valley royalties, when Sailfish took it over in 2019. I decided to stay in the stock after the deal closed: Terraco was buried in debt but Sailfish had imminent cash flow to clean up the balance sheet. I still have the 2019 deck bookmarked where they outlined the strengths of the combined entity.

Sounded good to me. I owned FISH.V up until late last year and to be fair to Sailfish they did the following …

initiated a dividend

repurchased shares

fully paid back more than $12-million in debt

But several decisions along the way left me with the impression this was Wexford’s world and the rest of us were just living in it. Last week, Sailfish decided to throw that 2019 slide out — scale isn’t the way to go anymore.

“After receiving feedback from shareholders, Sailfish is exploring a potential structure that would contemplate separating the Spring Valley royalties from the Nicaraguan and Mexican assets. Over the next few months, the Company will be investigating this proposed structure. Separately, and as part of the Company's existing strategy, Sailfish will seek to complete highly accretive transactions, with the aim of significantly expanding its silver exposure while maintain or growing its industry leading dividend.”

If I were still a shareholder, I’d be hoping this is all a fancy way of saying they’re selling Sailfish to a bigger royalty company at a nice premium. That does not seem to be the case.

If ‘separate’ isn’t code for ‘sell’ - this exercise is predicated on the assumption that public markets would value a non-cash flowing royalty on a deposit owned by a private company the same way as a strategic buyer. I don’t agree: another fish-named, Wexford-controlled entity seems pointless.

Electric Royalties … less said the better

What a clown show …

My assumption was wrong and this was not bridge financing. Very dilutive financings for marginal junk just seems to be the way ELEC.V does business. No need to waste too much time on this.

My apologies for the overall negative tone in this post. I’ll try to come up with something more positive next time.

Interesting Links

enCore Energy rings the opening bell at the New York Stock Exchange Monday morning. An NYSE listing opens up the stock to a whole new class of short sellers.

I don’t have any unique insight about the business prospects for Peloton. I think anyone who works out regularly understands the economics of fitness-based businesses are terrible. That said, I suspect Goodlife Fitness prints money by staying off the radar and buying up the carcasses of failed competitors for the last 30 years or so.

Yes to creatine. No to green powders.

Those group RESPs aren’t a scam, but like most financial products they don’t outperform a basic index fund: “I’ve rarely had a client, once I explain how they work, who has not felt cheated.”

I have some pretty strong views on work from home. One of them is Allied Property REIT has an exposed flank. Its buildings are on the edge of Toronto’s downtown core and its main tenants are the technology and creative sectors that are selling work-from-home as a benefit to key employees. With that context, it’s no surprise AP.UN is making the right call to fix its finances by selling its data centres.

Toronto needs to follow Calgary’s lead and reimagine its downtown core. The sooner the better considering its budget hole.

Reading doesn’t need to take up a lot of your time.