I'm back

In this issue:

I'm back after a long absence

My uninformed take on the BoC and FOMC

What's coming

I'm back

For most of you, this is the first newsletter you've ever received from me. This makes sense since I haven't sent a newsletter since 2018. In the meantime I've changed careers, gotten divorced, settled down again and moved several times, all while grinding through COVID-19.

The last iteration of the newsletter was too macro for me. I make my money as an investor picking winners out of the trash so that will be my focus going forward. For the journalists who liked my previous emails for the story ideas, I'll try to keep some of that ... although it seems most of you are doing something else at this point.

Inflation situation and market reaction

By now everyone knows there was no change in interest rates, but with the promise of higher rates down the road. What I took out of this is non asset holders are being screwed by design. I don't think anyone seriously believes central banks or the government are willing to deflate an asset bubble that is collateralizing a lot of debt.

I have no idea how to trade this market and I'm not going to try, but I think this guy has the right idea.

I nibbled at a few things and had some stink bids hit. But my general plan is to go long commodities and hard assets with scarcity value. I also have to think long and hard about whether I want to take some profits on my Ethereum plays or ride the volatility with an outsized position.

An aside on housing prices

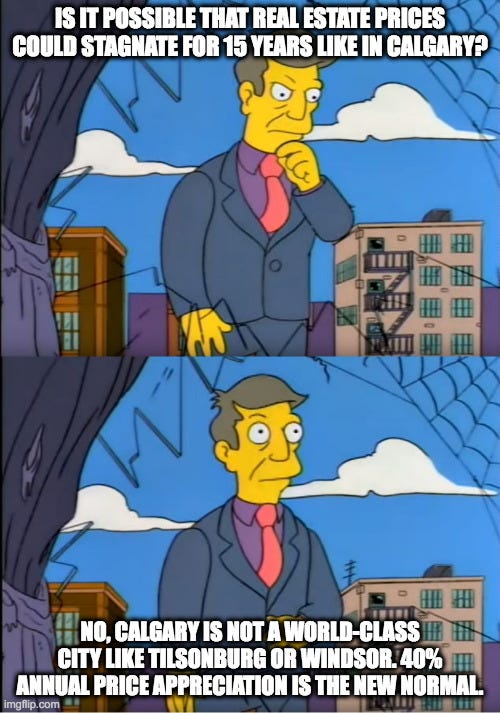

The bond market is pricing in at least four rate hikes, which equates to a 20% drop in home prices.

While it's nice to see Toronto export something to small town Ontario other than its garbage, I'm not sure the residents of Tilsonburg appreciate being priced of out the town they've lived in their entire life. Five months away from a provincial election and there's still plenty of time for housing to become the campaign issue that distracts from Covid. Anecdotally, I've had three separate women and one man tell me they've run into this issue while looking for a place to live.

Two tier societies have a habit of exploding at very inopportune times for politicians. It is time for some enterprising journalist to break out some cleavage and a hidden camera.

Interesting links

This isn't feasible with the current labour shortage. Besides, I thought everyone was moving to Tilsonburg.

Net cash flow is the missing piece of information here. If technology has been deflationary for retail property prices/demand and inflationary for industrial, aren't we past due for technology (in this case remote work) to distort the office market?

Focus on process rather than results.

What's coming

I've been enjoying life and spending less time on markets and writing. To keep this particular dispatch short, here's what I have planned.

Updates coming on Consolidated Rock:

Portfolio report as of January 31

Changes to the gold basket as trades have been closed and opened. In particular I added Great Bear Royalties and closed out an options trade on Equinox at a loss.

I've been waiting for a drop to publish my Ethereum manifesto. I think the current price action qualifies.

There will also be a full post-mortem on my adventures in Three Valley Copper, a failure of position sizing. I knew the company finances were trash and didn't size the bet appropriately.

But TVC.V is also a failure of time management ...

Expect more updates shortly before this settles down into a more regular and less frequent posting schedule.